In this post, I’ll describe my view on Bitcoin and Ethereum, what they mean to me and how this impacts my portfolio allocation.

But what if the bull market is over?

This post is not about cycles, or how and when would I sell. It’s about networks and their values.

Cover photo by La-Rel Easter on Unsplash

Internet’s Collateral

Jack Dorsey calls Bitcoin “Internet’s native money”, which is arguable, but maybe eventually it would be the native money of the internet.

Bitcoin (like most of the CB currencies) is a highly speculative asset/currency. Many of the new users in this space start with buying some Sats.

Some use it for lending/borrowing and more importantly is that some institutes use Bitcoin as explicit collateral to short the futures market.

Maybe in the near or far future, we see more adoption to secondary layers of Bitcoin, and so it will more participate in daily financial activities. But until then I see the Bitcoin as Internet’s collateral which many want to have it since it’s the hard money, if not the hardest money ever human touched. Although it can’t be touched.

Internet’s Financial System

While we hear more big players are jumping on board of Bitcoin bit big caps, Ethereum expansion and adoption among the mass is stunning. Let’s see some stats together:

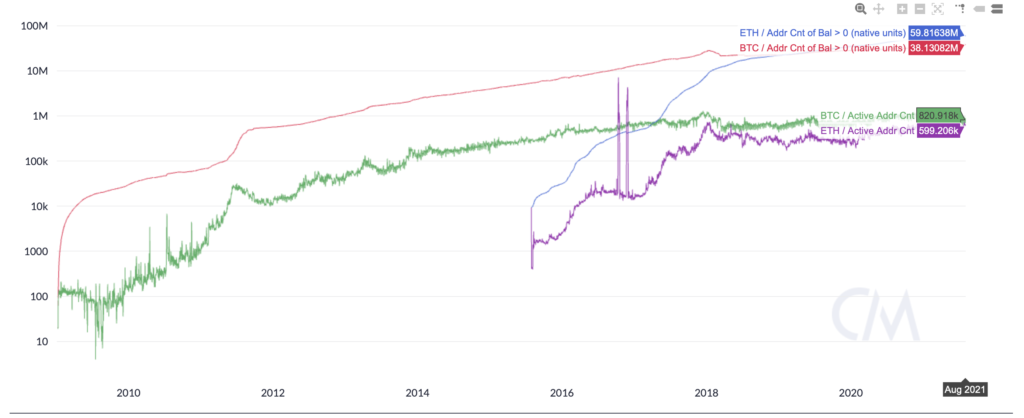

Address count with non-zero balance

Although it came 6 years later than Bitcoin, it’s non-zero addresses already surpassed it. Below is the logarithmic view:

Of course address count does not represent unique users, but we will see some other stats. Also currently active addresses is very high, in according with Ethereum’s release date.

It’s not about the best, it’s about networks

Let’s take instant messaging apps as an example. Particularly WhatsApp and Telegram, I use both, no matter how much I hate dislike WhatsApp.

I use it since many of my friends, and businesses which I want to contact use it.

Although my main field is software development and not UX, from a user standpoint, I suffer every second of using WhatsApp.

And yet… the network effect beats “better”. And there are sometimes “better” get the chance of having greater network effect, but we’re not always lucky.

Keeping the “better” argument away, there are some events that some networks that outpaced other networks, for instance, Facebook beating MySpace network.

In the case of Ethereum, we don’t have a clear indication that other networks can beat it in the near future (but keep in mind that everything is changing so fast).

The reason that I believe that Ethereum and Bitcoin can co-exist and it won’t be a winner-take-all situation, is just because that I don’t see them as direct competitor networks as described in Internet’s Collateral and Internet’s Financial System sections.

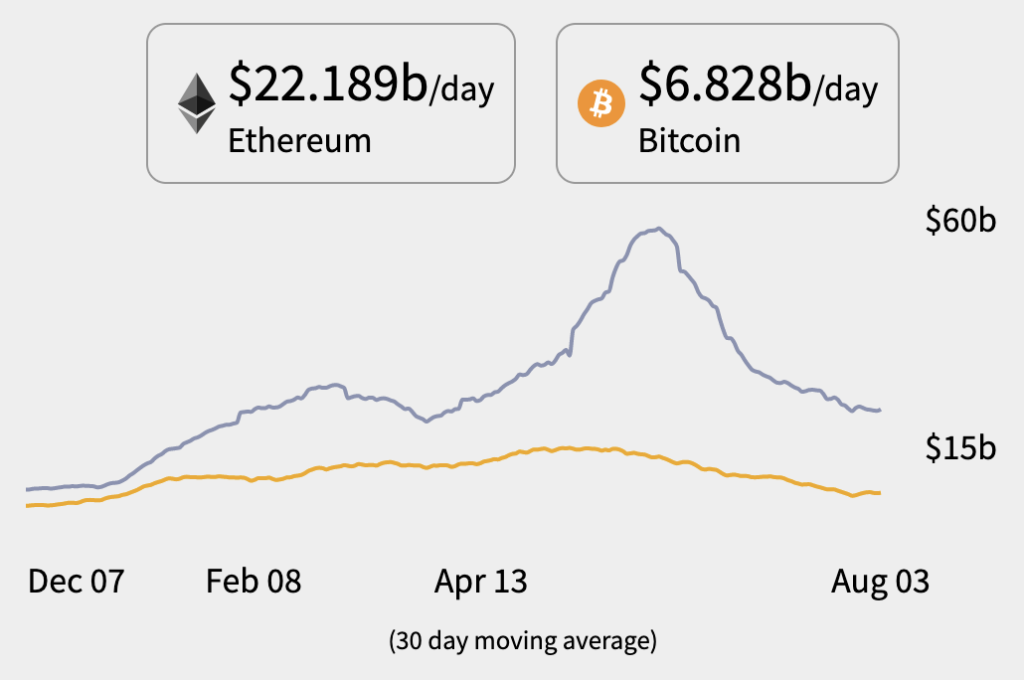

Above image is the net value of fees users are paying to networks and DAPPS, and although Ethereum’s contracts fees are higher than a Bitcoin SegWit transaction, users are willing to pay for it. And we already discussed the growth of active addresses.

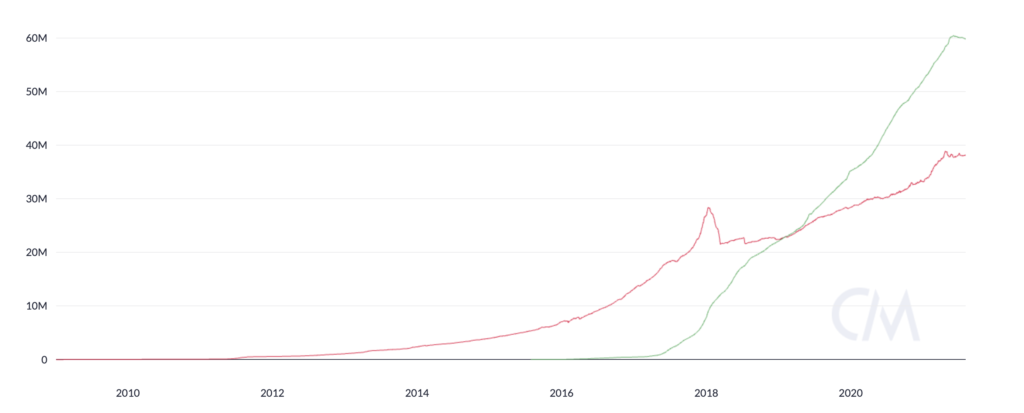

Money movers: Ethereum is leading

By this time, Ethereum network is the biggest money mover network in cryptocurrencies space, by far.

With historical perspective the significance of this will blur out as we proceed.

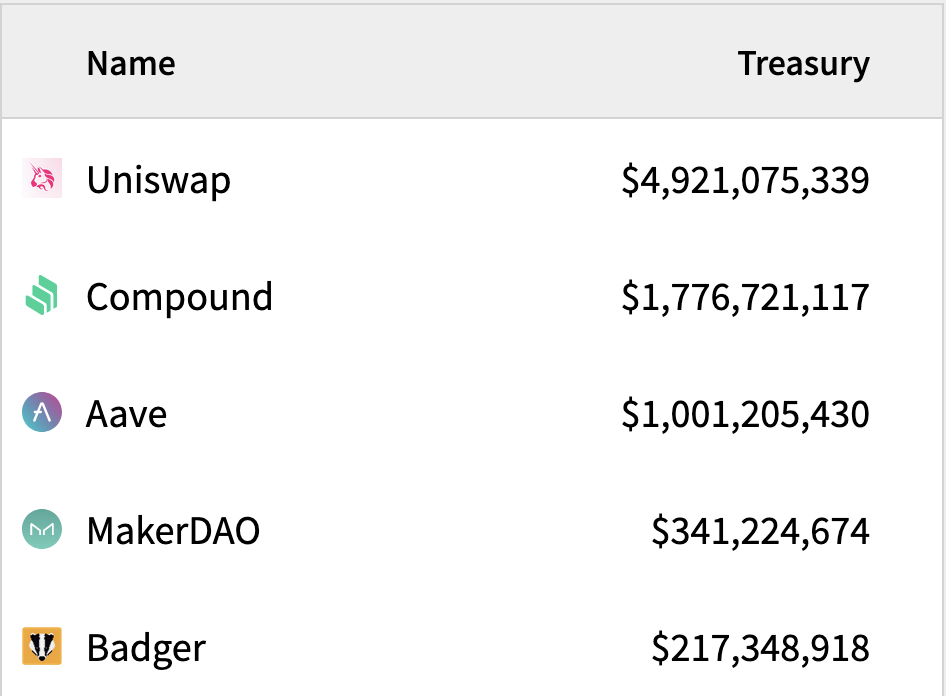

It’s not just about moving money, this can become more about cash flow, and DAOs and therefore their governance may play a bold role in this.

Forewords

With Ethereum’s recent update, which makes it kinda deflationary (although there are some concerns), many emerging layer 2s solutions, and upcoming transition towards ETH 2, I believe since we don’t face a catastrophic security event, Ethereum’s market cap will surpass Bitcoin in future. And makes it attractive to put more weight on the portfolio.